https://www.bloomberg.com/news/feat...-the-69-billion-backing-the-stablecoin-tether

Is Tether a Ponzi scheme

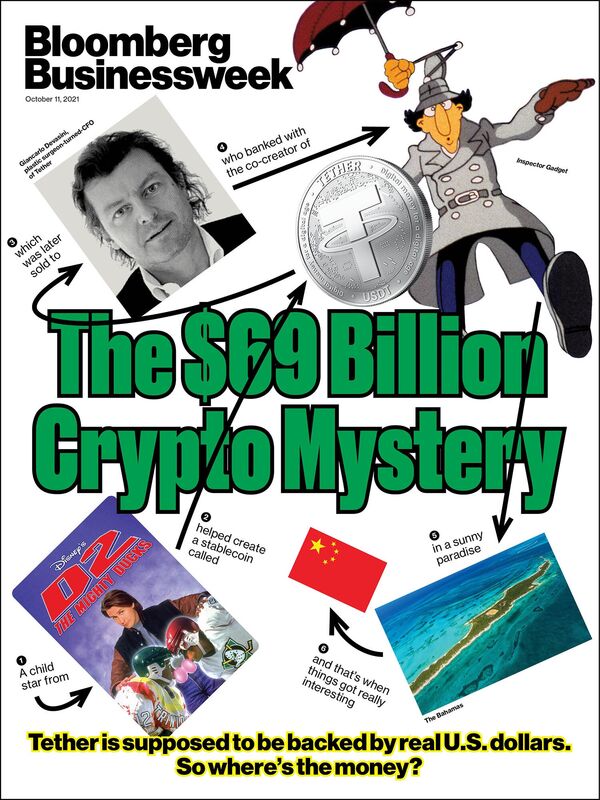

Tether is what’s come to be known in financial circles as a stablecoin—stable because one Tether is supposed to be backed by one dollar. But it’s actually more like a bank. The company that issues the currency, Tether Holdings Ltd., takes in dollars from people who want to trade crypto and credits their digital wallets with an equal amount of Tethers in return. Once they have Tethers, people can send them to cryptocurrency exchanges and use them to bet on the price of Bitcoin, Ether, or any of the thousands of other coins. And at least in theory, Tether Holdings holds on to the dollars so it can return them to anyone who wants to send in their tokens and get their money back. The convoluted mechanism became popular because real banks didn’t want to do business with crypto companies, especially foreign ones.

Featured in Bloomberg Businessweek, Oct. 11, 2021.

Subscribe now.

PHOTOS: TETHER (DEVASINI); WIT OLSZEWSKI/ALAMY (COIN); EVERETT COLLECTION (GADGET); DISNEY (D2); AND JUAN CARLOS MUNOZ/ALAMY (BAHAMAS)

Exactly how Tether is backed, or if it’s truly backed at all, has always been a mystery. For years a persistent group of critics has argued that, despite the company’s assurances,

Tether Holdings doesn’t have enough assets to maintain the 1-to-1 exchange rate, meaning its coin is essentially a fraud. But in the crypto world, where joke coins with pictures of dogs can be worth billions of dollars and scammers periodically make fortunes with preposterous-sounding schemes, Tether seemed like just another curiosity.

Then

, this year, Tether Holdings started putting out a huge amount of digital coins. There are now 69 billion Tethers in circulation, 48 billion of them issued this year.

That means the company supposedly holds a corresponding $69 billion in real money to back the coins—an amount that would make it one of the 50 largest banks in the U.S., if it were a U.S. bank and not an unregulated offshore company.

On Twitter, on business TV, and on hedge fund and investment bank trading floors, everyone started asking why Tether was minting so many coins and whether it really had the money it claimed to have. An anonymous anti-Tether blog post titled “The Bit Short: Inside Crypto’s Doomsday Machine” went viral, and CNBC host Jim Cramer told viewers to sell their crypto. “If Tether collapsed, well then, it’s going to gut the whole crypto ecosystem,” he warned.

As far as the regulators are concerned, the size of Tether’s supposed dollar holdings is so big that it would be dangerous even assuming the dollars are real. If enough traders asked for their dollars back at once, the company could have to liquidate its assets at a loss, setting off a run on the not-bank. The losses could cascade into the regulated financial system by crashing credit markets. If the trolls are right, and Tether is a Ponzi scheme, it would be larger than Bernie Madoff’s.

This is the co founder of tether.....doesn't look the least bit shady